Simple Ira Contribution Limits 2021

For SEP IRAs contribution limits will increase to 61000 per year for 2022 up from 58000 per year in 2021. 2021 SIMPLE IRA contribution limit is 13500 or 16500 if age 50 or older.

Ira Contribution Limits 2021 Requirements 2021

The SIMPLE IRA and SIMPLE 401k contribution limits will increase from 13500 in 2021 to 14000 in 2022.

Simple ira contribution limits 2021. And contribution limits generally increase every year or two in order to keep pace with inflation. What is the maximum SIMPLE IRA contribution limit for 2021. The contribution limits are.

Here are the traditional IRA phase-out ranges for 2021. 105000 to 125000 Married couples filing jointly. Employees who are participants in employer-sponsored SIMPLE IRA plans can contribute 14000 for 2022.

66000 to 76000 Single taxpayers covered by a workplace retirement plan. Likewise the contribution limit for a SIMPLE IRA which is a retirement plan designed for small businesses with 100 or fewer employees stays put at 13500 for 2021. The amount you can contribute to a Simple IRA or Simple 401k remains 13500 in 2021 and the catch-up limit for those age 50 or older remains 3000.

Education 5 hours ago SIMPLE IRA Contribution Limits for 2021 SmartAsset. 2022 Traditional and Roth IRA Contribution Limit. For 2019 annual employee salary reduction contributions elective deferrals limited to.

On November 4 the Internal Revenue Service IRS announced 2022 inflation-adjusted limits for all retirement plans including SIMPLE IRA plans. Like both of these plans the SIMPLE IRA is. For 2020 and for 2021 annual employee salary reduction contributions elective deferrals limited to 13500.

If you are age 50 or over the catch-up contribution limit will stay the same at 3000 in 2022 as in 2021. SIMPLE IRA A Savings Incentive Match Plan for Employees SIMPLE IRA allows employees and employers to contribute to traditional IRAs for employees. Income Ranges for 2021.

If you are age 50 or older you may contribute 1000 more or 7000 total. SIMPLE IRA Contribution Exceptions. In 2021 the maximum SIMPLE IRA contribution limit for employees under age 50 is 13500.

A SIMPLE IRA is funded by. This SIMPLE IRA contribution limit remains unchanged from the fiscal year 2020. For employees age 50 or over a 3000 catch-up contribution is also allowed.

13500 annually and 16500 if youre over 50 You cant contribute more than you earn. The SIMPLE IRA contribution limits will increase to. Employees 50 and older can make an extra 3000 catch-up contribution if their plan allows it.

Employees can contribute up to 13500 per year in 2020 and 2021 to their SIMPLE IRAs. 13500 plus a catch-up contribution of 3000 for those 50 and older in 2021 and 2020. Employees age 50 or over can contribute an extra 3000 as a catch-up contribution.

A SIMPLE IRA is easy to set up and has low administrative responsibilities. However because the SIMPLE IRA plan limits your contributions to 14000 in 2022 13500 in 2020-2021 plus an additional 3000 catch-up contribution this is the maximum amount you can contribute to your SIMPLE IRA plan. For 2021 the annual contribution limit for SIMPLE IRAs is 13500 the same amount as the year before.

2021 SIMPLE IRA Contribution Limits. 198000 to 208000 A taxpayer not covered by a. You may contribute to one or the other or both as long as you dont go over the 6000 or 7000 limit for all of your contributions.

For 2021 the annual contribution limit for SIMPLE IRAs is 13500 the same amount as the year before. For 2021 the amount employees may contribute to a SIMPLE IRA plan is capped at 13500 per year. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up by 500 from 13500 in 2021 to 14000 in 2022.

If you participate in more than one retirement plan your total elective deferrals cant exceed the annual limit 19500 in 2021 plus any applicable catch-up contributions. There are two types of IRAs traditional and Roth. If you are self-employed or an employee with access to a SIMPLE IRA then the maximum contribution you can make for the fiscal year 2021 is 13500.

This is the same as the 2020 limit but an increase from 2019s limit of 13000 and an even bigger leap from the 12500 limit imposed from 2015 to 2018. This number may increase in future years to help adjust for inflation. Max Simple Ira Contribution 2021 University.

In addition there is a maximum 3 employer contribution. Besides you can make a catch-up contribution of up to 3000 per tax year if you are age above 50. However an exception exists for employees aged 50 or older at the end of the calendar year.

For 2021 your IRA contribution is unchanged at 6000. This a 500 per year increase from 2019. Education 4 hours ago A SIMPLE IRA is an excellent tool for small business owners to help their employees save up for retirementThis type of retirement account combines features of both the traditional IRA and the 401k.

You cant contribute more than the contribution limits. This has increased from the 2021 contribution limit of 13500. The annual employee contribution limit for a SIMPLE IRA is 13500 for both 2020 and 2021.

2021 SIMPLE IRA Contribution Limits. Employee SIMPLE IRA Contribution Limits for 2021 An employee cannot contribute more than 13500 to a SIMPLE IRA in 2021. This applies when the spouse making the IRA contribution is covered by a workplace retirement plan.

Employer contributions arent included in these limits.

Mercer Projects 2021 Ira And Saver S Credit Limits

Sep Ira Contribution Limits 2021 Tax Deductible 2021

2021 Contribution Limits Human Investing

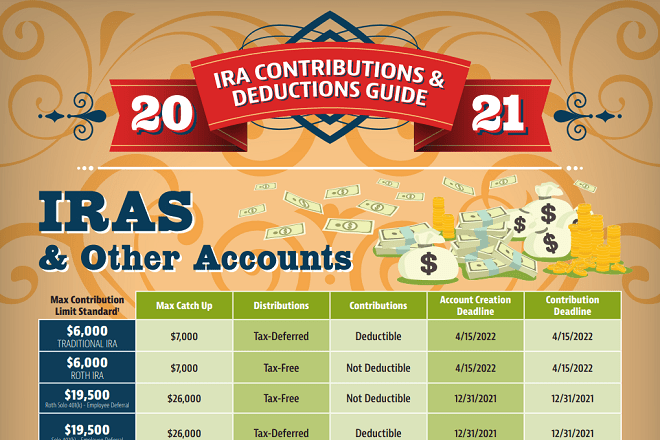

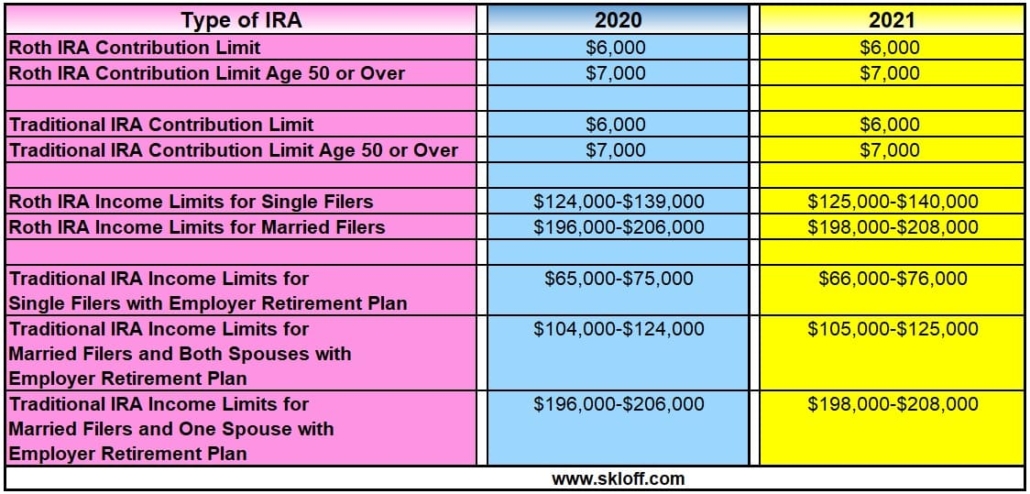

Ira Contribution And Income Limits For 2020 And 2021 Skloff Financial Group

2021 Retirement Plan Contribution Limits Northwest Bank

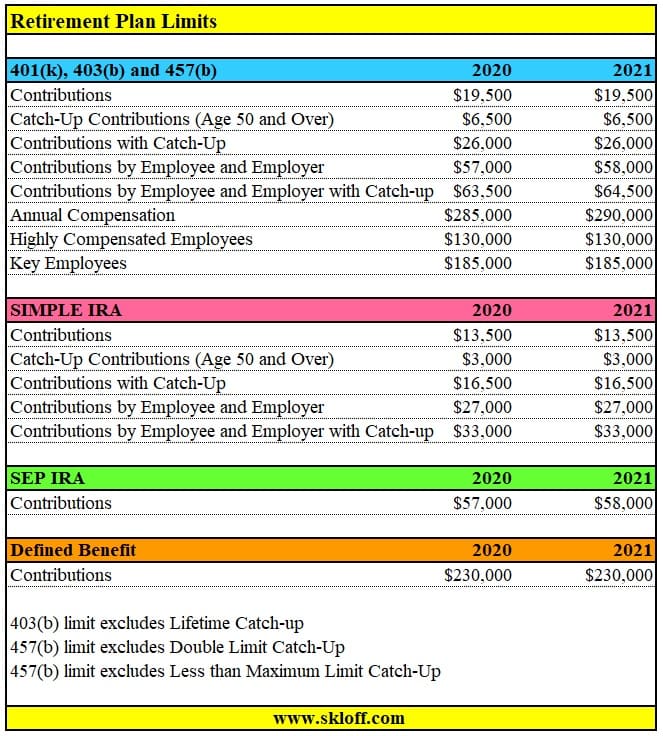

Retirement Plan Limits 2020 And 2021 Skloff Financial Group

Ira Contribution Limits Charting Your Financial Future

Will Roth Ira Contribution Limits Increase In 2021 2021

Sep Ira Contribution Limits 2021 Tax Deductible 2021

Ira Contribution Limits 2021 Requirements 2021

![]()

Ira And Retirement Plan Limits For 2021 Pg Co

![]()

Ira And Retirement Plan Limits For 2021 Pg Co

2020 2021 Ira Contribution Limits Catch Up Provisions Equity Trust Company

Ira Contribution Limits Increase By Strata Trust Company Harvest

Posting Komentar untuk "Simple Ira Contribution Limits 2021"