Simple 401k Limits 2021

The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up by 500 from 13500 in 2021 to 14000 in 2022. SIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans.

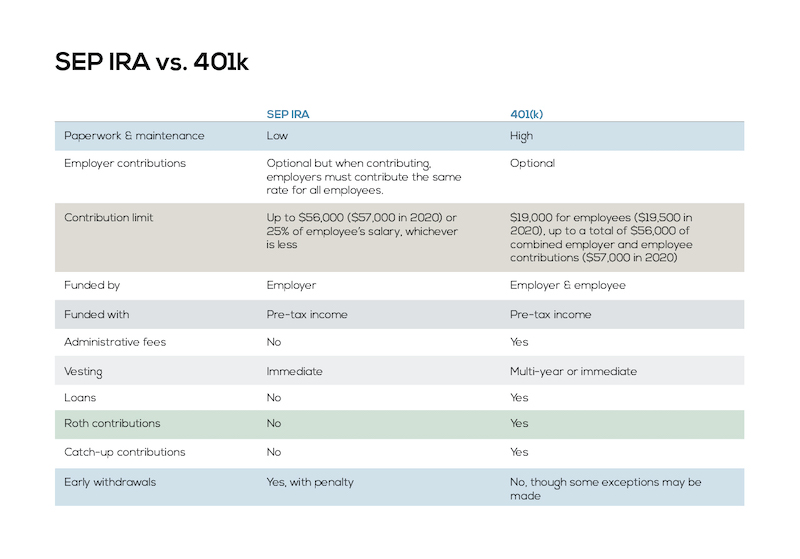

Traditional Ira Income Limits 2021 With 401k 2021

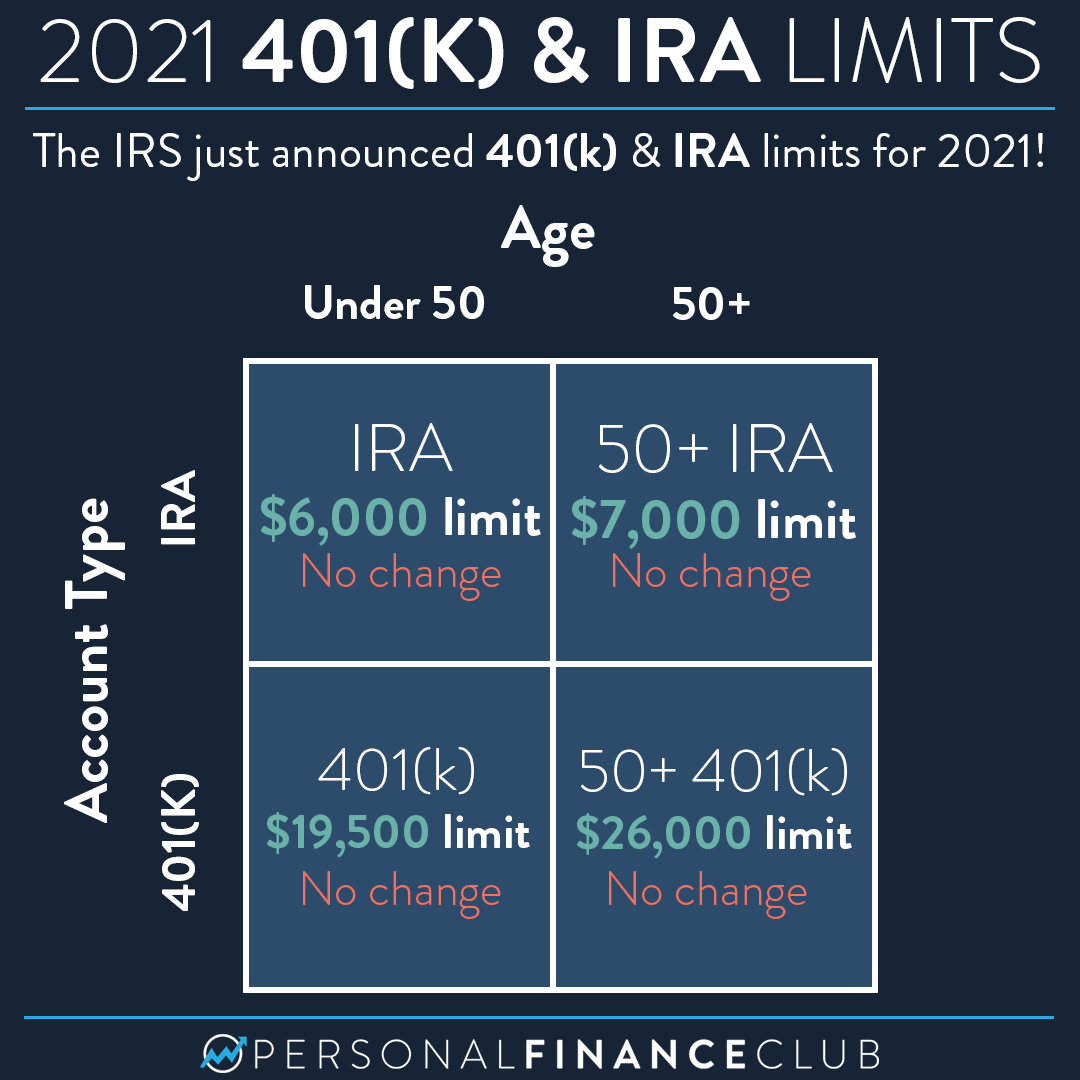

The IRS says as of October 2020 that 401k contribution limits 2021 will remain unchanged from 2020s at 19500.

Simple 401k limits 2021. In 2021 employees can contribute up to 13500 to a SIMPLE IRA account significantly more than the 6000 limit of traditional and Roth IRAs but less than the 2021 19500 401k limit. That brings the annual total to 26000 for taxpayers 50 and over. The Internal Revenue Service announced Thursday that the amount individuals can contribute to their 401k plans in 2022 has increased to 20500 up.

13500 in 2021 and 2020 13000 in 2019 This amount may be increased in future years for cost-of-living PDF adjustments. 401k and Retirement Plan Limits for the Tax Year 2021 On October 26 2020 the Internal Revenue Service announced that employees in 401k plans will be able to contribute up to 19500 next year. All of the basic limits remain the same in 2021.

A financial advisorcan help you create a retirement plan for your needs and goals. 19000 in 2019 or the ADP test limit of section 401k3 or the plan limit if any. If the employee is age 50 and over an additional catch-up contribution is allowed.

The elective deferral limit for SIMPLE plans is 100 of compensation or 13500 in 2020 and 2021 13000 in 2019 and 12500 in 2018. 2022 SIMPLE 401k and SIMPLE IRA Contribution Limit. SIMPLE IRA contribution limits 2020 for employees.

401k Contribution Limit Projected at 19500 for 2021 401k and Retirement Plan Limits for the Tax Year 2022 On November 4 2021 the Internal Revenue Service announced that employees in 401k plans will be able to contribute up to 20500 next year. 2021 SIMPLE IRA Contribution Limits. 2021 Pension Plan Limitations.

Governmental 457b Elective deferrals are not treated as catch-up contributions until they exceed the limit of 20500 in 2022 19500 in 2020 and 2021. The limit on employee elective deferrals to a SIMPLE 401 k plan is. IRS announces 401 k limit increases to 20500.

Retirement Plan Contribution Limits for 2021. IRA contribution limits remain unchanged from 2021. IR-2021-216 November 4 2021.

If you have multiple 401k accounts your total contributions to all of themboth traditional and Rothcannot exceed that 19500 limit. Employee- 13500 in 2020 and 2021 13000 in 2019 and 12500 in 2018. You may contribute up to 19500 of earned income to your 401K in 2021 This contribution limit also applies to 403b plans most 457 plans and the federal governments Thrift Savings Plan.

The amount you can contribute to your SIMPLE retirement accounts increased 500 to 14000 for 2022 up from 13500 in 2021. The IRS announced this and other changes in Notice 2020-79. 401k other than a SIMPLE 401k 403b SARSEP.

Contribution Limits That Stayed the Same. This is the same as the 2020 limit but an increase from 2019s limit of 13000 and an even bigger. For 2021 the annual contribution limit for SIMPLE IRAs is 13500 the same amount as the year before.

Keep in mind that if you are age 50 or above you are allowed an additional catch-up contribution of 6500. 2021 Salary-Deferral 401k Contribution Limits Individual plan participants can contribute up to 19500 of their wages in 2021. The additional contribution amount is 3000 in 2021 2020 2019 and 2018.

For 2021 the amount employees may contribute to a SIMPLE IRA plan is capped at 13500 per year. 401k Contribution Limits 2021. For those ages 50 and older the catch-up contribution is capped at 6500.

401k Contribution Limits 2021 Contributions to employee 401 k plans will remain capped at 19500 in the plan year 2021 with a catch-up contribution of 6500 available to individuals reaching age 50 or older. For 2021 employees who are saving for retirement through 401ks 403bs most 457 plans and the federal governments Thrift Savings Plan can contribute up to 19500 to those plans during the year. Savers can stash away an extra 1000 in their 401ks in 2022 the IRS announced.

The basic limit on elective deferrals is 19500 in 2020 and 2021 19000 in 2019 18500 in 2018 and 18000 in 2015 - 2017 or 100 of the employees compensation whichever is less. WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 k plans in 2022 has increased to 20500 up from 19500 for 2021 and 2020. Between you and your employer the maximum that can be put into your 401k in 2021 is 58000 if you add catch-up contributions that limit rises.

401k Contribution Limits For 2021 Good Money Sense Money Sense Health Savings Account 401k

Ira Contribution Limits 2021 With No 401k 2021

Solo 401k Contribution Limits And Types

Traditional Ira Income Limits 2021 With 401k 2021

Ira Contribution Limits 2021 With No 401k 2021

401k Contribution Limits For 2021 Good Financial Cents Stock Market Stock Market Crash Annuity

401k Contribution Limits For 2021 Good Money Sense Money Sense Personal Finance Advice Budget Planning

401k And Retirement Plan Limits For The Tax Year 2021

2021 401 K Contribution Limits On Limits 2021 401k Contribution Limits 2021

2021 Annual Compensation And Contribution Limits Retirement Plans How To Plan Retirement Planning Budget Planner

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Ira Contribution Limits For 2020 And 2021 Tax Brackets Standard Deduction Irs

401k Contribution Limits For 2021 Good Money Sense Ways To Save Money Saving Money 401k

Posting Komentar untuk "Simple 401k Limits 2021"